NFT

Earlier this yr, the brand new market Blur made waves within the NFT sector. Latest numbers recommend its lending platform may create an analogous buzz. Nonetheless, there are actual and severe dangers when borrowing towards an NFT.

Blur’s lending platform, Mix, has shortly gained recognition since its launch simply ten days in the past. In accordance with information from Dune dashboard, customers have already borrowed a staggering 51,656 ETH—equal to $95 million—towards their digital collectibles. Impressively, over 3,000 particular person loans have been opened on the platform to date.

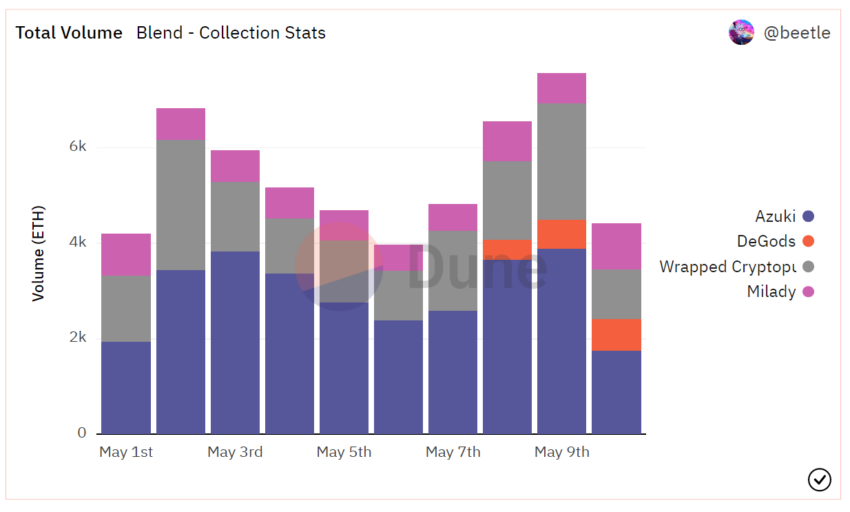

Mix Helps 4 Collections

Mix presently helps loans backed by 4 NFT collections: Miladys, Azukis, DeGods, and wrapped variations of CryptoPunks.

Blur generated a buzz earlier within the yr with its impression on the NFT market. Quickly after launch, it surpassed OpenSea, the king of NFT marketplaces, with 53% market share. Blur’s native token airdrop in Q1 2023 drove vital traction to the NFT market and aggregator, leading to a surge in Ethereum‘s NFT buying and selling volumes.

Mix, also referred to as Blur Lending, seems prefer it would possibly do even higher. Since its launch, Blur’s lending platform has swiftly surpassed rivals like NFTfi, Arcade, and BendDAO, driving the NFT mortgage quantity to a formidable $67 million in only one week.

Mix’s loans alone make up a outstanding 75% of the full quantity. Presently, the full variety of accepted and refinanced loans is 3,045, with 922 distinctive lenders, in keeping with Dune.

Mix is the most recent participant to hitch the market. However utilizing NFTs as collateral has been standard since 2021 because of the emergence of recent platforms and the rising price of digital property. In more moderen months, costs have been extra muted. In any occasion, utilizing NFTs as collateral presents extreme dangers to lenders.

Supply: Dune

Liquidity Threat

Utilizing an NFT for collateral will not be not like utilizing different property to fund loans. Debtors deposit their NFT as collateral, set mortgage phrases, and obtain ETH from the lender, whereas the NFT stays as collateral. The borrower then repays the mortgage to retrieve the NFT. A failure to repay leads to liquidation and the lender claiming possession of the NFT.

Nonetheless, NFT lending platforms like Blur pose a hazard by enabling collectors to purchase tokens with out having the mandatory funds. This creates liquidity dangers sooner or later when assortment flooring instantly tank.

A liquidity danger arises when a borrower won’t have sufficient money to satisfy its monetary obligations—on this case, the mortgage.

Taking up loans on NFTs can require a margin name to keep away from liquidation. A margin name happens when the lender requests extra collateral from you to compensate for the decreased worth of the asset.

In 2022, merchants had been floored after BAYC NFT costs plummeted by 80% in six weeks. A lot of them had over-leveraged themselves through the use of their Apes as collateral for taking loans on BendDAO. Dozens of those that did confronted margin calls.