Following the surge in Bitcoin worth, DeFi initiatives throughout the board are hovering on Thursday.

Bitcoin rose 15% following the FOMC assembly Wednesday and information of a technical recession on Thursday. Nonetheless, the DeFi sector is seeing probably the most vital positive aspects.

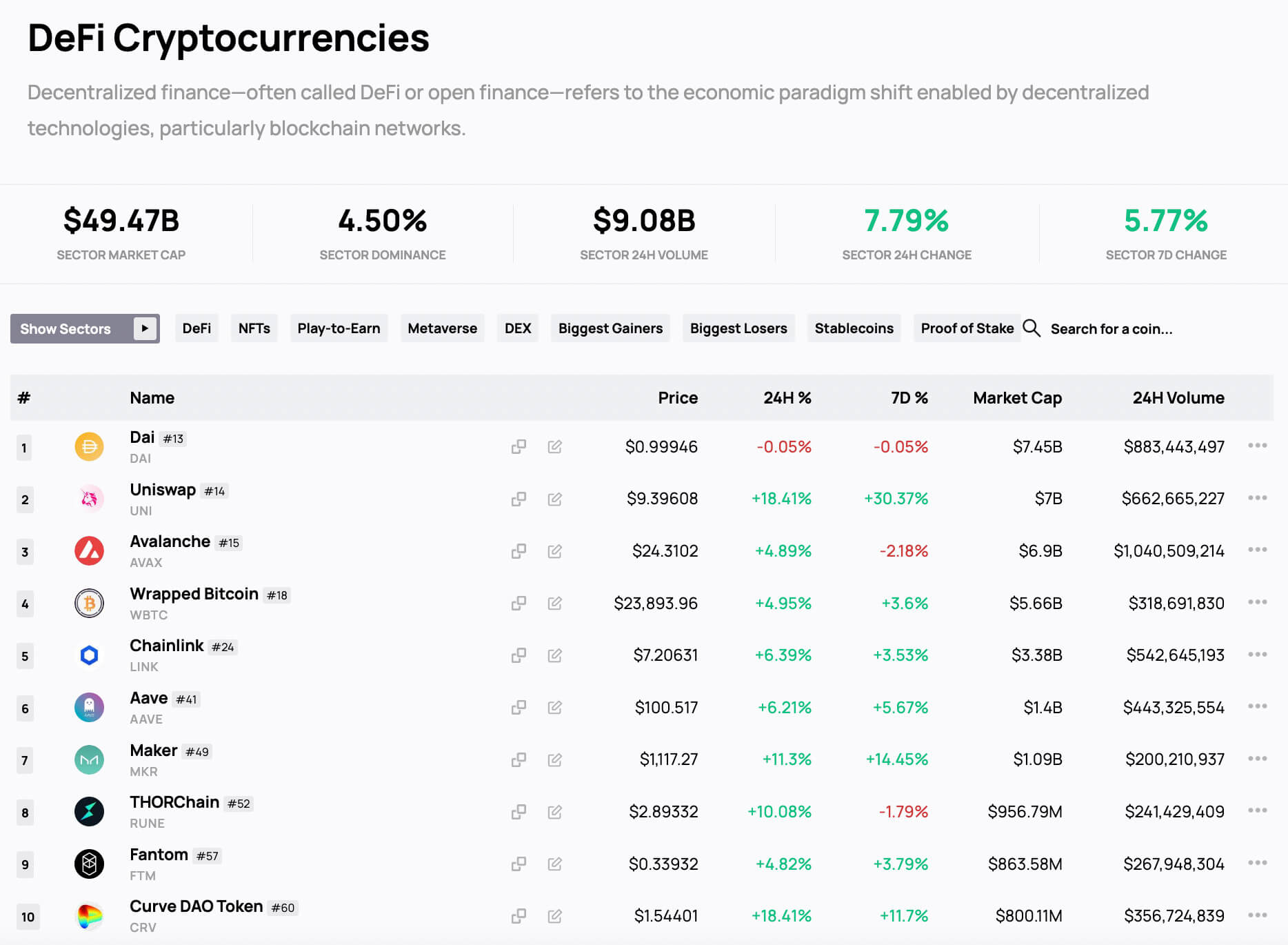

Out of the highest 10 DeFi cash tracked by CryptoSlate, solely ThorChain has been down over the previous seven days. All cash and tokens are up between 10 to 56% previously 24 hours.

Solend, a serious Solana-based DeFi protocol, appears to suppose permissionless swimming pools might kick begin a DeFi Summer time in 2022.

What are Permissionless Swimming pools and why have they got the potential to kick off a brand new DeFi summer time?

— 🙏🚫 Solend (we’re hiring!) (@solendprotocol) July 19, 2022

The protocol acknowledged, “Permissionless Swimming pools are remoted swimming pools that anybody can launch. This permits lengthy tail property to be listed. Permissionless Swimming pools share charges with the creator, enabling a brand new income stream for customers.”

Hedera, the corporate behind the Hashgraph undertaking, imagine that sun shades are to guard buyers throughout their DeFi summer time.

☀️Alright #HBARbarians – in celebration of @Hedera‘s #DeFi #NFT Summer time and to supply our superb neighborhood some safety from the warmth, we’re freely giving 10 pairs of Hedera SĦades! Put your information to the take a look at with the Q’s under for an opportunity to win – submit hyperlink @ finish of the🧵 pic.twitter.com/rZGiZczRpt

— Hedera (@hedera) July 22, 2022

Whereas DeFi analyst, LilMoonLambo, tweeted 9 days in the past that DeFi summer time had already began and “few notice this.”

DeFi summer time is occurring once more, proper now.

Few notice this.

— LilMoonLambo (@LilMoonLambo) July 19, 2022

With the hotter climate coming for the western hemisphere as we transfer into August and an area excessive for Ethereum of $1,700 on Thursday, it might be simple to get carried away on the hopium. The DeFi summer time of 2020 that marked the beginning of the final bull run occurred in a vastly completely different world than the one we reside in at present.

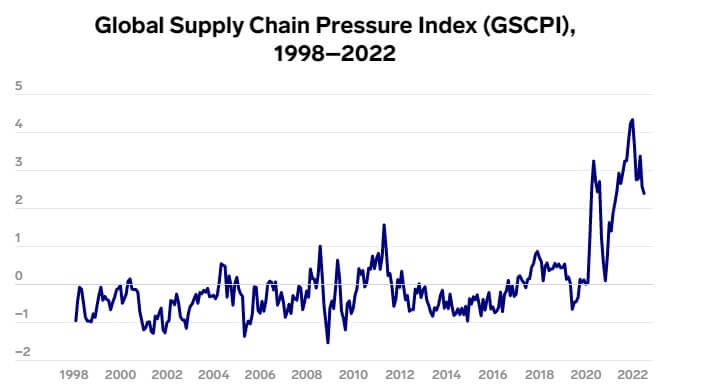

The primary two quarters of 2022 have revealed a technical recession is current inside the US, with different vital economies going by means of comparable difficulties. Warfare remains to be waging in Ukraine, and the supply chain subject is way from over.

Nonetheless, an indicator posted by Enterprise Insider signifies that stress on the provision chain could also be decreasing. Strain has been falling for the reason that begin of 2022 after reaching an all-time excessive on the finish of 2021. Ought to issues with sourcing items go away, the speed of cash ought to improve, thus eradicating stress from different components of the worldwide economic system.

As this chart from the St. Louis FED reveals, the speed of cash is lastly on the rise which means more cash is being spent within the economic system in comparison with GDP. The M1 velocity of cash is “calculated because the quarterly nominal GDP (GDP) ratio to the quarterly common of the M1 cash inventory.”

DeFi Summer time shouldn’t be outlined as a couple of heat days between July and September the place DeFi tokens pump earlier than crashing again to earlier ranges. It’s extremely early to be calling the present rally a DeFi Summer time. Nonetheless, the DeFi sector may undoubtedly be one to look at as Ethereum strikes in the direction of The Merge this September.