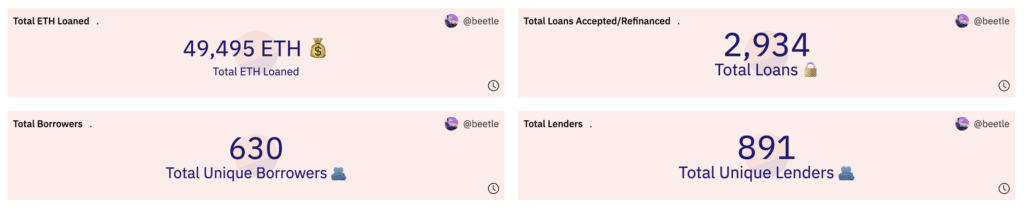

Dune Analytics information exhibits that since Blur launched the NFT lending market Mix on Might 2, the market has facilitated 49,495 ETH loans, and a complete of two,934 loans have been matched, of which the variety of impartial debtors is 630 and the variety of impartial lenders was 891.

The introduction of Mix has raised worries about its doable affect on the entire market. The lending platform, a cutting-edge peer-to-peer lending platform, permits merchants to lease NFTs to be able to improve liquidity and appeal to new clients. A number of specialists, nonetheless, fear that this new approach could endanger the market and token holders.

Its main aim is to take away monetary boundaries for in style NFT collections, permitting new purchasers to hitch the ecosystem extra simply. Mix improves the market’s variety of merchants and transactions by enabling holders to lease out their NFTs to collectors on the lookout for extra cheap entry to blue-chip NFTs.

Mix, based on Blur, intends to draw new purchasers to its ecosystem by reducing the monetary hurdles to entry for in style NFT collections. As a consequence, it contributes to the general liquidity of the NFT ecosystem by boosting the variety of merchants and transactions.

The lending market shall be free to make use of for each debtors and lenders when it launches. However, after 180 days, BLUR token holders will be capable to vote on whether or not to cost Mix use charges.

Regardless of its obvious benefits, Mix will not be the perfect platform for each inexperienced dealer. As assortment flooring or cryptocurrency costs fall, NFT lending providers like Mix enable collectors to amass tokens with out sufficient cash, thereby inflicting liquidity issues and market instability.

One of many greatest worries about Mix is its relationship with Blur, the highest NFT platform when it comes to commerce quantity. Its already fervent person base could select to lease NFTs somewhat than purchase them outright, thus harming each the market and the native BLUR token.

DISCLAIMER: The knowledge on this web site is supplied as common market commentary and doesn’t represent funding recommendation. We encourage you to do your analysis earlier than investing.