NFT

In Q1 2023, the overall statistics of the NFT market elevated strongly in comparison with This autumn 2022, consolidating the energy of an trade that till a number of months in the past had been given up for useless.

Let’s check out what the principle drivers of this development have been and which NFT collections had the best volumes.

All the main points under.

Market statistics: NFT volumes rising strongly

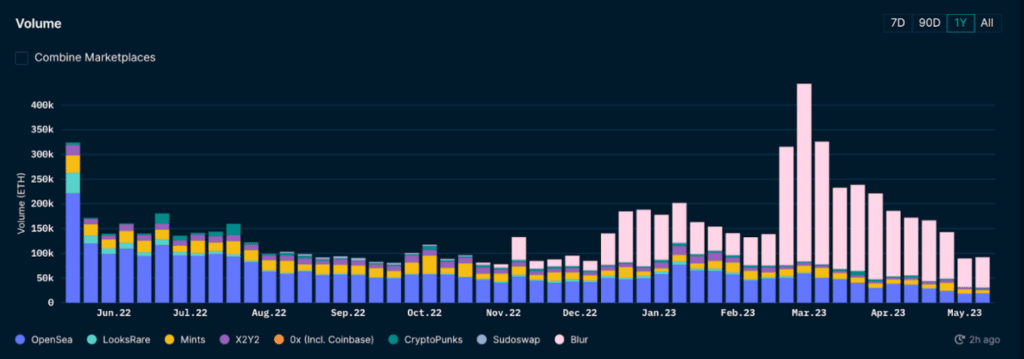

In Q1 2023, we noticed a rise in NFT gross sales volumes in comparison with This autumn 2022, confirming that the non-fungible token market is extra vibrant than ever.

The information reveals a rise in each ETH and USD volumes: particularly, within the final months of 2022, there have been gross sales of greater than 9 million NFTs, equal to 1,525,471 ETH or roughly $1.97 billion, whereas within the first three months of 2023, gross sales have been just below 11.5 million with a quantity of two,839,354 ETH or $4.54 billion.

The variety of customers additionally elevated from 11.23 million in This autumn to 14 million in Q1, indicating not solely that the collections are extra widespread, but additionally that public curiosity on this market has elevated.

The primary motive for this development appears to be the launch of Blur, NFT’s market for skilled merchants, which has attracted the involvement of the crypto group.

On this sense, the start of 2023 signalled the tip of OpenSea’s unchallenged hegemony because the trade’s main platform, in favour of the newly shaped Blur, which was extra widespread each for its user-friendly dashboards and for the wealthy information accessible for every market assortment.

At present, the 2 marketplaces compete for almost all of the NFT sector’s gross sales quantity.

Nevertheless, there was a short dip in April and the downward development appears to have continued into the primary days of Might, though the forecast for Q2 2023 is optimistic.

It stays to be seen whether or not curiosity will match or exceed this Q1 2023 stage within the coming months and whether or not Opensea, particularly, will be capable of regain among the market share misplaced to Blur.

It would even be fascinating to see if NFTs on Bitcoin, enabled by the emergence of Ordinals, turn into mainstream and ‘steal’ among the volumes presently flowing on Ethereum and different suitable EVM chains.

Which NFT collections have the best gross sales volumes?

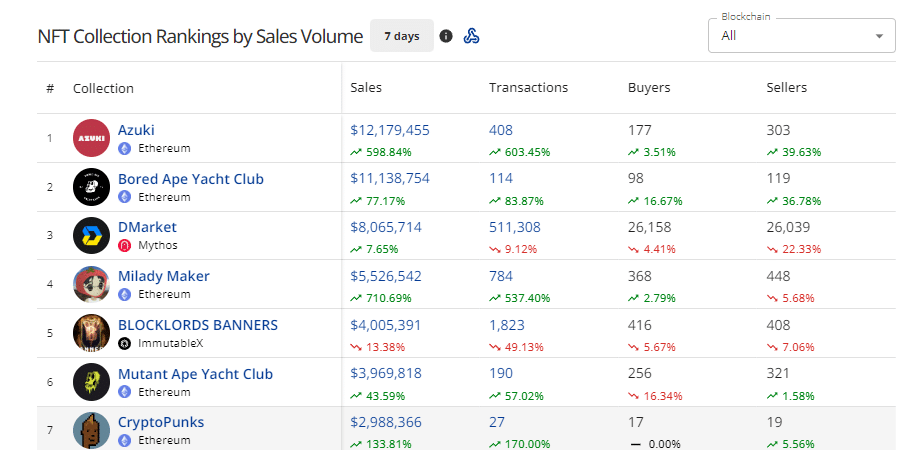

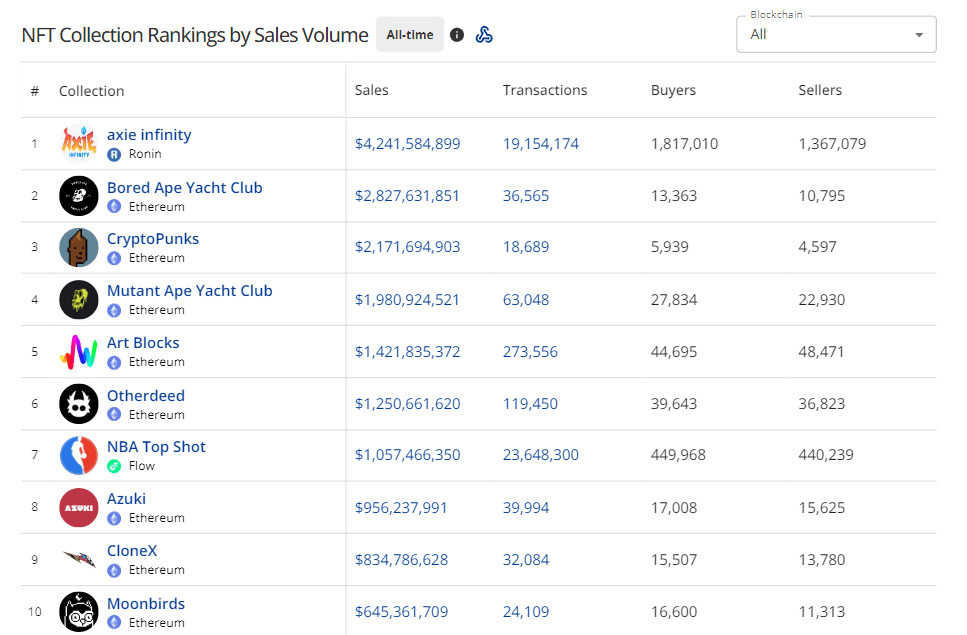

After this transient overview of the NFT market, allow us to analyse which collections have the best gross sales volumes by distinguishing 3 exact moments: the final 7 days, the final month and the all-time information. All information is taken from the CryptoSlam platform.

Relating to the final 7 days, the highest 3 collections with the best quantity have been these of Azuki, Bored Ape Yacht Membership and DMarket.

The primary two belong to the Ethereum blockchain, whereas the final one belongs to the Mythos chain.

In complete, the three collections generated a complete quantity of $31.3 million.

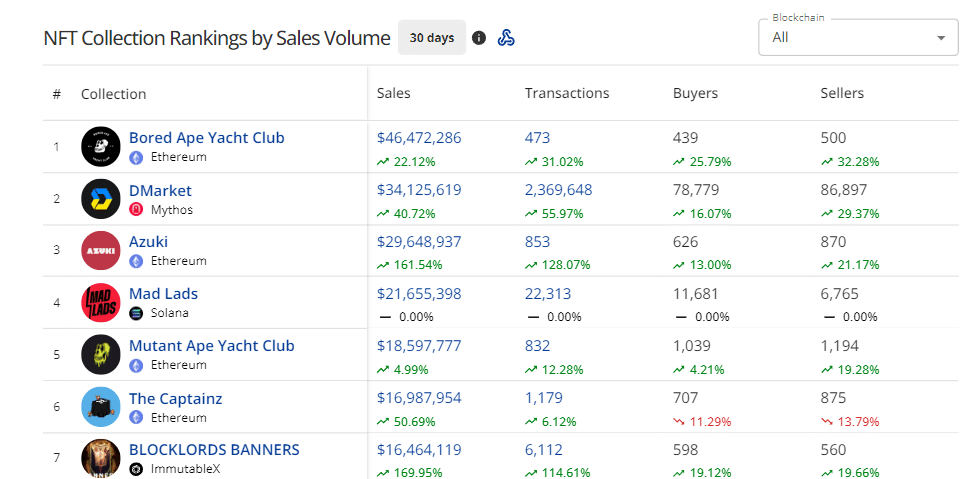

Within the final 30 days, the identical collections are current on the rostrum, however in numerous positions.

In reality, Bored Ape Yacht Membership is in first place with $46.47 million in gross sales, adopted by the DMarket assortment with $34.1 million and eventually Azuki with $29.6 million.

Additionally noteworthy is the entry of Mad Lads, a set developed on Solana, within the high 5, whereas Blocklords Banners, a part of the ImmutableX community, appeared within the high 10.

Lastly, wanting on the historic values (all-time), we see how Ethereum confirms itself as the main blockchain for the event of NFTs, as virtually all the high 10 collections of all time have been deployed and offered on this community.

Particularly, the one non-Ethereum assortment and the one with probably the most gross sales is Axie Infinity, developed on the Ronin chain, with a quantity of $4.24 billion.

Subsequent comes Bored Ape, which confirms the general public’s curiosity in each the brief and long run with $2.82 billion in gross sales, and the very talked-about Crypto Punks assortment with $2.17 billion.

The final 7 collections within the high 10 embody names corresponding to Mutant Ape Yacht Membership, Artwork Blocks, Otherdeed, NBA Prime Shot, Azuki, CloneX and Moonbirds.

Collectively, these names have offered a complete of $17.36 billion. The best promoting NFT was Crypto Punk #5822, which offered for $23.2 million a yr in the past.

Pattern of the second: Ordinals and non-fungible tokens on Bitcoin

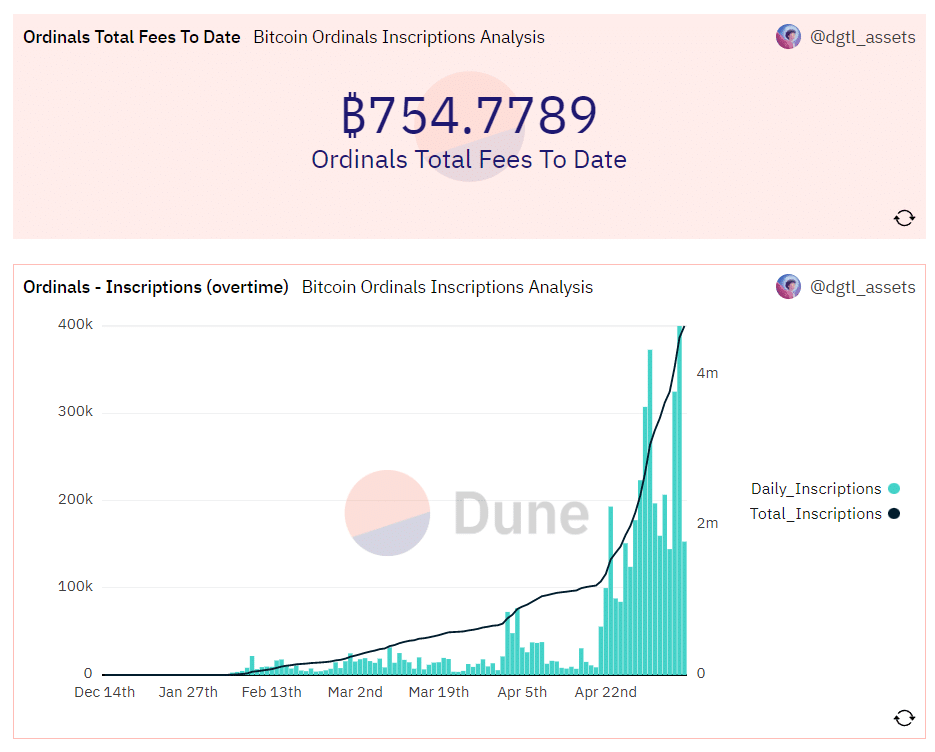

Past the amount of NFT gross sales information, it is rather fascinating to analyse the development of the second, particularly Ordinals and inscriptions on the Bitcoin blockchain.

As most individuals know, the Bitcoin community doesn’t assist sensible contracts like all fashionable blockchains, so it is unattainable to difficulty fungible tokens and NFTs on it.

Nevertheless, Ordinals, a protocol invented by Bitcoin Core developer Casey Rodarmor, has made it attainable to create digital artefacts from the smallest models of Bitcoin, the Satoshi.

The development appears to have exploded in current days, with 1000’s of individuals creating NFTs and fungible BRC-20 tokens on high of Bitcoin.

When it comes to non-fungible tokens alone, there have been greater than 4.5 million registrations since February 2023, when phrase of the development started to unfold, with projections for development within the coming months.

Whereas this represents an enormous step ahead for the usefulness of the Bitcoin community, the Ordinaries inscriptions don’t appear to be appreciated by many customers, who’ve been pressured to pay greater than ordinary to make use of the blockchain, even when solely to switch BTC from one pockets to a different.

On this regard, on Sunday 7 Might, Binance was pressured to quickly droop BTC withdrawals (all different withdrawals remained open, together with FIAT withdrawals) on account of very heavy community congestion and the a whole bunch of 1000’s of transactions caught within the mempool ready to be confirmed and added to a blockchain.

So whereas this development could seem to be a sport changer for Bitcoin’s blockchain structure and the prospects for its future use, it needs to be weighed towards the difficulties skilled on the person aspect.

Maybe one resolution can be to quickly swap to the Lightning Community, which has now turn into an establishment for the Bitcoin group, and cut back the quantity of labor that Layer 1 is pressured to course of by way of off-chain computation.

Sadly, a “single layer” resolution for all web3 transactions appears disappointing for each Bitcoin and Ethereum, whereas the longer term is transferring in direction of a differentiation of the areas wherein every layer has to compete, primarily based by itself stage of safety, transparency and decentralisation.

Sooner or later, it will be good to see an interoperable platform able to mechanically managing any form of cross-chain operation by way of a unified resolution, simple to make use of and appropriate even for novice customers, who sadly are presently unable to deal with the complexity of the blockchain world.