The Bitcoin value has failed to interrupt above the important thing resistance stage of $27,800 since Monday. With at this time’s launch of the US Client Worth Index (CPI), a directional determination could also be imminent: Will Bitcoin climb once more in direction of $30,000 or is a drop to $25,000 looming?

Who Will Buckle First?

The Client Worth Index (CPI) can be introduced an hour (8:30 am EST) earlier than the US buying and selling session opens. Headline inflation on an annual foundation (YoY) is predicted to be unchanged at 5.0% (vs. 5.0% final time). The core price is predicted to fall barely, from 5.6% to five.5%. On a month-to-month foundation, headline CPI is predicted at 0.4% vs. 0.1% final and the core price at 0.3% vs. 0.4% final.

At the moment’s CPI launch may very well be of main significance as a result of there’s a important discrepancy between the US Federal Reserve (Fed) and market expectations. In response to the dot plot and Jerome Powell, there are not any price cuts scheduled this 12 months, whereas in keeping with the CME FedWatch device, the market is asking a bluff and the bulk is forecasting two to a few price cuts.

One aspect should buckle prematurely, and if the CPI numbers are available worse than anticipated, it may very well be the market. Consequently, it may be anticipated that the inventory market will plummet and probably drag Bitcoin down as properly. A constructive shock in at this time’s CPI numbers is subsequently extremely important for the market.

Remarkably, Goldman Sachs expects core CPI to rise by 0.47% in April, above the consensus of 0.3%. This is able to additionally put the annual price at 5.59%, above consensus of 5.5%. The banking large additionally predicts headline CPI to rise to 0.50% (vs. 0.4%), which might raise the annual price to five.09% (vs. 5.0%).

Bitcoin Forward Of CPI

Forward of the CPI launch, the Bitcoin value is caught in a tough state of affairs. The bears are beginning to really feel in management, however the bulls proceed to have the higher hand within the increased time frames.

As analyst @52skew notes, there are indicators that the Bitcoin perpetuals market is oversaturated with brief positions. Whereas the Bitcoin Perp CVD Buckets & Delta Orders present some liquidation of brief positions, they nonetheless present heavy brief positioning on upswings. That is “usually outlined as brief management,” the analyst stated. Binance spot is the market promoting aggressor at this time.

$BTC Spot CVD Buckets & Delta Orders

Nonetheless very a lot the identical, each day vwap illustrates when MMs are twap promoting into value through small spot orders / MM spot orders & TWAP CVD / MM CVDBounces nonetheless being bought by MMs.

Binance spot is the market promoting aggressor at this time https://t.co/k02hc5qCDL pic.twitter.com/hwVw1YJcqm

— Skew Δ (@52kskew) May 10, 2023

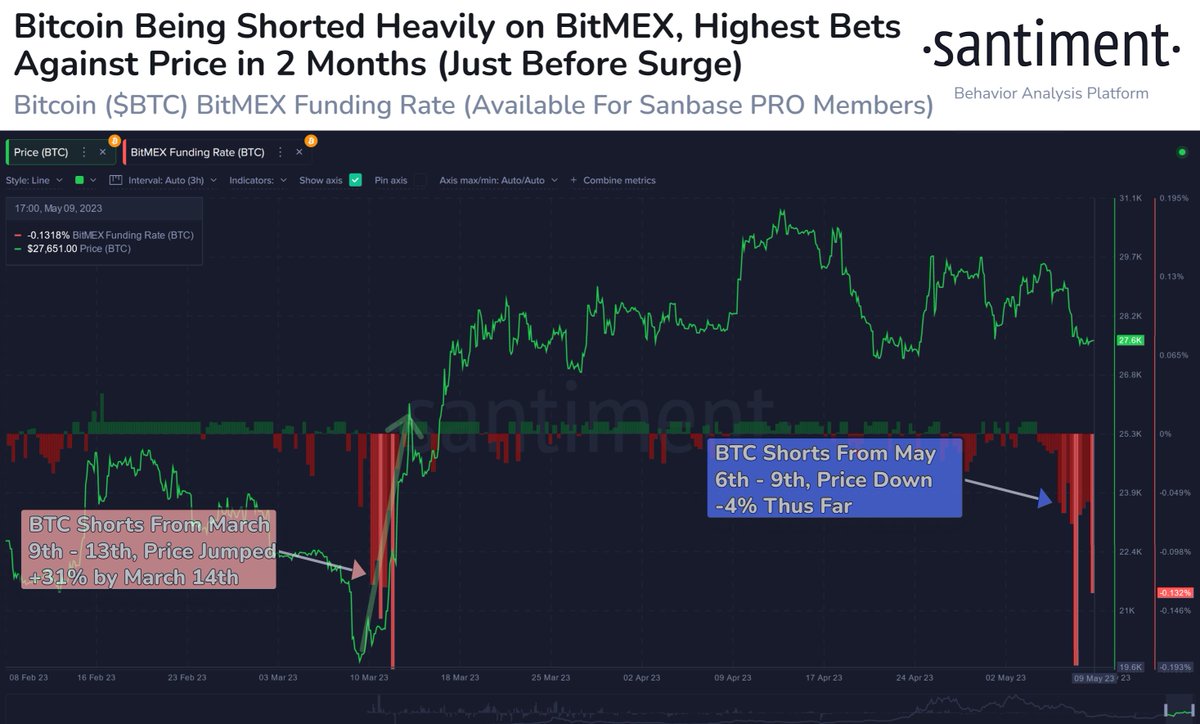

Alternatively, an previous ‘reversion indicator’ of 2019 is simply flashing up: Bitmex buying and selling beneath spot. As on-chain evaluation service Santiment additionally observes, Bitcoin’s funding price on BitMEX is displaying its most adverse ratio for the reason that large bets towards costs in mid-March, simply earlier than costs spiked.

“Typically, value rise possibilities improve when the gang overwhelmingly assumes costs can be dropping,” Santiment concludes.

In any other case, a head & shoulders sample within the 1-day chart is at present being hotly debated. The bearish aspect argues that BTC is going through a deeper fall. However, there are additionally good arguments why this needn’t be the case.

Chartered Market Technician (CMT) Aksel Kibar makes the argument that chart patterns needs to be analyzed in relation to the earlier value motion:

Whereas this final one month consolidation appears to be like like a H&S high, high reversals kind after an prolonged uptrend, in consequence can’t be analyzed as a high reversal. I’m extra to play the lengthy aspect of this one month lengthy consolidation. Assist (neckline for backside reversal) continues to be at 25K.

At press time, the Bitcoin value traded at $27,647.

Featured picture from iStock, chart from TradingView.com